south dakota sales tax rates by county

What is the total sales tax rate in South Dakota. They may also impose a 1 municipal gross.

How To Charge Sales Tax In The Us A Simple Guide For 2022

South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65.

. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. One field heading that incorporates the term Date. This includes the rates on the state county city and special levels.

South Dakota has a 45 sales tax and Lake County collects an additional NA so the minimum sales tax rate in Lake County is 45 not including any city or special district taxes. The 2018 United States Supreme Court decision in South Dakota v. What is the sales tax rate in Turner County.

Rates include state county and city taxes. Look up 2021 South Dakota sales tax rates in an easy to navigate table listed by county and city. Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65.

Find your South Dakota combined state and local tax rate. Some cities and local governments in Day County collect additional local sales taxes which can be as high as 3. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

The South Dakota Department of Revenue administers these taxes. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. Tax amount varies by county.

Some cities and local governments in Codington County collect additional local sales taxes which can be as high as 2. Municipalities may impose a general municipal sales tax rate of up to 2. Other local-level tax rates in South Dakota are relatively complex when compared to other states local-level tax rates.

Lowest sales tax 45 Highest. The minimum combined 2022 sales tax rate for Turner County South Dakota is. This is the total of state and county sales tax rates.

Free sales tax calculator tool to estimate total amounts. Custer County SD Sales Tax Rate. Rate search goes back to 2005.

The South Dakota sales tax of 45 applies countywide. There are a total of 290 local tax jurisdictions across the state. The South Dakota sales tax of 45 applies countywide.

The South Dakota sales tax of 45 applies countywide. Counties and cities can charge an additional local sales tax of up to 2 for a. This is the total of state and county sales tax rates.

45 South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6. For a more detailed breakdown of rates please refer to our. 31 rows The latest sales tax rates for cities in South Dakota SD state.

One field heading labeled Address2 used for additional address information. 128 of home value. 2020 rates included for use while preparing your income.

In addition to the sales tax cities can levy a 2 municipal. 366 rows 2022 List of South Dakota Local Sales Tax Rates. The Beadle County sales tax rate is.

By March 2025 when the initial sales tax sunsets the projected revenue will be approximately 80 million less than originally anticipated for 2015 - 2025. The sales tax rate in Sioux County South Dakota is 45. Some cities and local governments in Meade County collect additional local sales taxes which can be as high as 2.

The South Dakota state sales tax rate is currently. The minimum combined 2022 sales tax rate for Lake County South Dakota is. The South Dakota state sales tax rate is currently.

Sales Use Tax South Dakota Department Of Revenue

South Dakota Sales Tax Rates By City County 2022

Sales Taxes In The United States Wikipedia

Taxes Spearfish Economic Development

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Pennsylvania Sales Tax Guide For Businesses

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

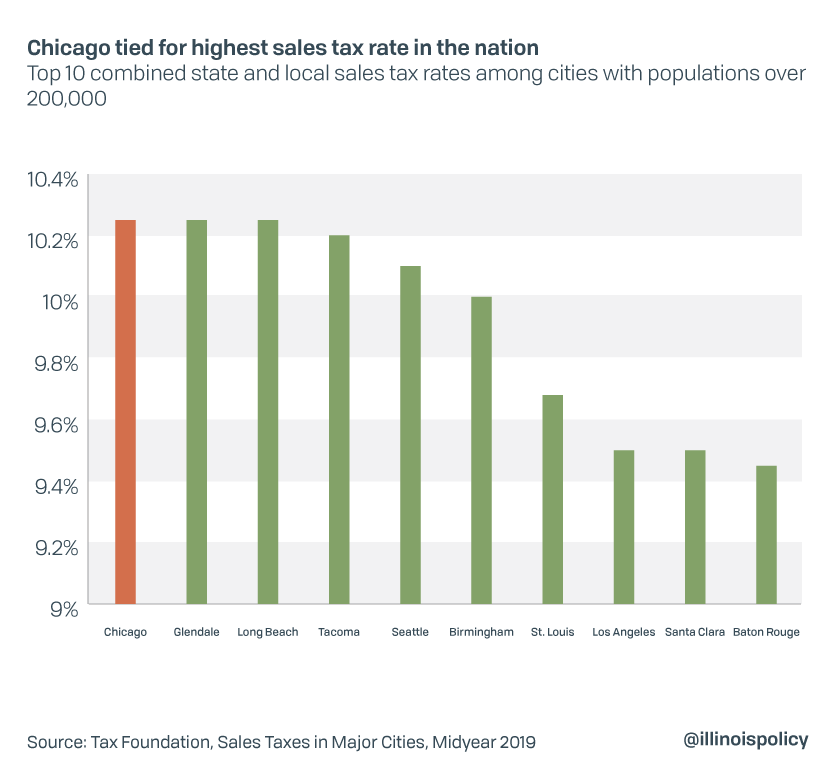

Chicago Defends Title Of Highest Sales Tax Rate In The Nation

Sales Use Tax South Dakota Department Of Revenue

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

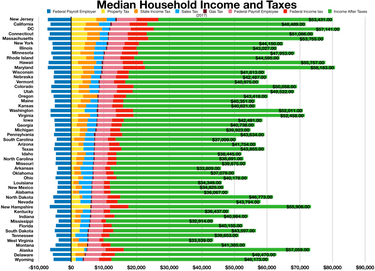

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Tennessee 2022 Sales Tax Calculator Rate Lookup Tool Avalara

States With The Highest Lowest Tax Rates

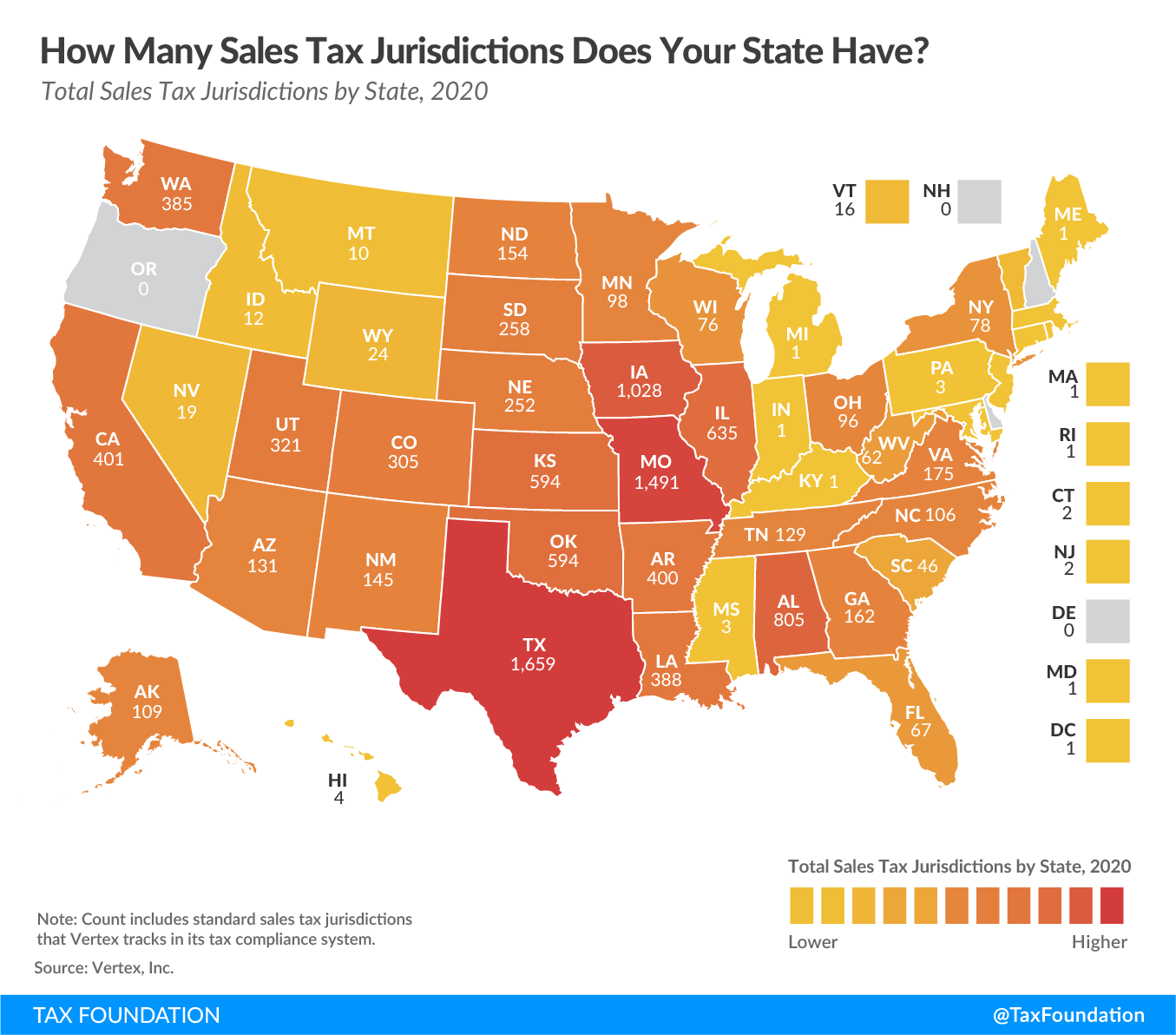

Sales Tax Jurisdictions By State 2020 Tax Foundation

Sales Use Tax South Dakota Department Of Revenue